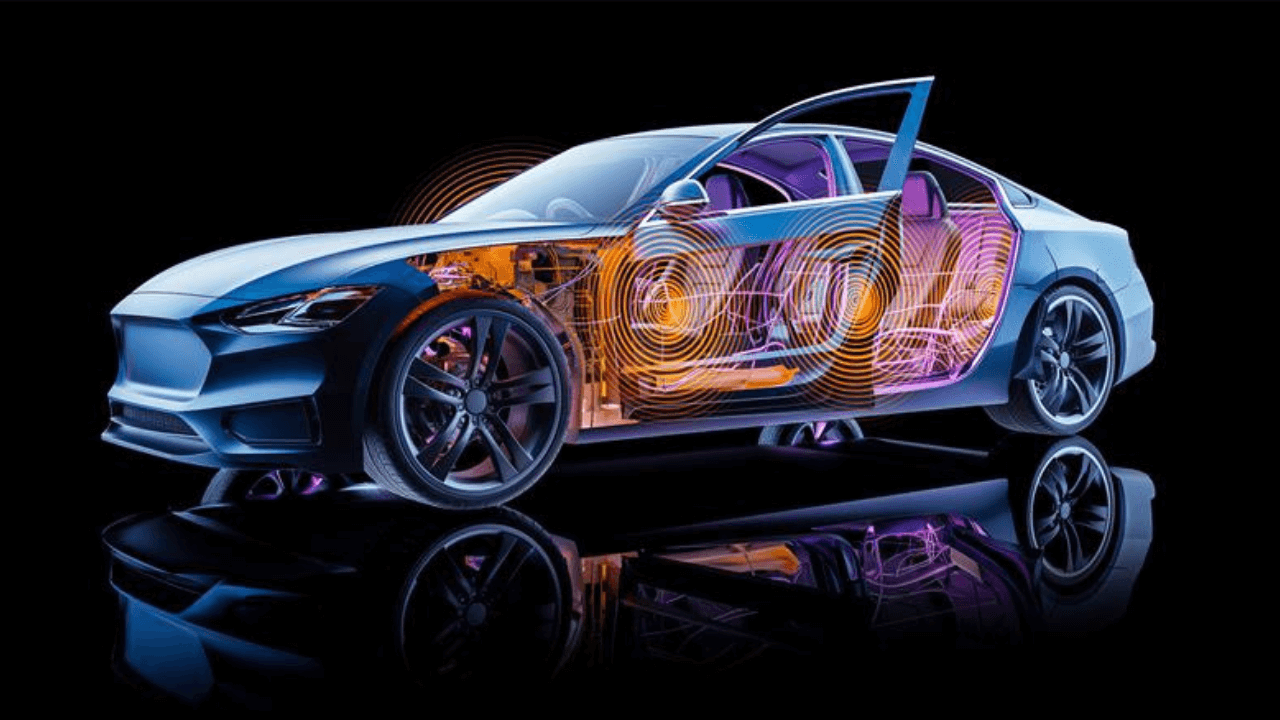

This is the second in a series of three posts on the rapidly changing world of in-car entertainment. In my previous piece, I identified the three factors driving innovation: high-quality screens, 5G connectivity, and familiar operating environments like Linux and Android supporting browser-based solutions. These modern glass dashboards are essentially networked tablets on wheels. Combine that with surround sound speakers, and the car becomes a second living room and a great place to watch and listen to content.

So, with all that in mind, let’s take a deeper dive into the factors impacting how this market evolves and the opportunities in-car entertainment presents to consumers, advertisers, content producers, and automakers alike.

What’s most exciting about this moment is that it’s the first real opportunity we’ve had to create a direct connection between the home and the car, with entertainment serving as the primary bridge. For generations, our entertainment and content brands have been at home in people’s living rooms. In parallel, our mobile devices serve up as much entertainment as we care to consume but, up until now, the car hasn’t been an environment where video and entertainment brands have had much of a presence. But let’s face it: we spend a lot of time in our cars these days. Today, we can bring video into the car in a way that feels natural and aligned with how people are already consuming video entertainment.

Looking at this through an automotive lens, our relationship with the car has traditionally ended at the driveway. But now there’s a way to extend that relationship into the home. For example, I might start watching a game in my car and then pick it up on my television when I get home — and vice versa. Understanding how this landscape evolves is going to be very valuable to automakers, entertainment brands, advertisers and an exciting time for consumers.

This new reality also opens up compelling opportunities for content and entertainment providers to deepen their relationships with consumers. Take Bloomberg or the BBC for example. They both have traditional radio stations, popular podcast series, and linear and on-demand video catalogs. What’s exciting about these multiformat content brands is that, in the car, we can seamlessly bridge the gap from one media format to another in a way that naturally enhances the brand and drives value for end-users.

Let’s say a driver or passenger has just watched a Bloomberg or BBC news piece about a particular topic and they want to go in-depth into the subject – now we can recommend a related podcast or radio program. Taking this one step further, we can make a recommendation and say, “would you like to add Bloomberg or the BBC to your radio presets?” So, it allows us, in a very organic and seamless way, to drive discovery across these multiformat assets and multiplatform brands.

There are several dimensions that will dramatically impact in-car viewership, and I’m excited to see how they unfold. First, we need to consider the geographical differences. Cultural values, consumer trends, regional video services, regulatory differences, and autonomous driving laws will all play roles in defining how consumers around the world watch in-car video.

Then there are the manufacturers. Will car brands and their loyal, sometimes fanatical, customers define unique viewing behaviors? Will we see different viewing patterns or content preferences between BMW, Tesla, Hyundai, VW, and Honda owners? Further along these lines, how will the type of car and the number of screens shape what consumers are watching? Dedicated passenger screens will no doubt drive more viewership, and a minivan with screens in the rear seat will very likely drive more viewing of kids’ content than what we might expect to see in a high-end sedan or coupe with a single screen oriented toward the driver. These attributes will become important factors impacting in-car entertainment and viewership.

Major entertainment brands and their apps will be important but increasingly, AI-driven discovery, personalization and recommendations will define a content-first (app-less) experience for consumers, serving the right content in the right format at the right time. Related to that content, we see great opportunities to work with advertising partners in ways that elevate, engage and connect brands to consumers. Depending on the type of content consumers are engaging with, we can open up new avenues for advertising, interaction, and affinity.

Intersecting geolocation and content first recommendations also creates interesting opportunities for advertisers to extend their relationship with consumers and their cars. Imagine someone has been watching home improvement or cooking shows in their car. We can then provide ways to engage with them by syncing a home goods or grocery store location with their nav system or suggesting a particular product and surfacing a relevant coupon or promotion. Or take news, sports and weather — where time-sensitive alerts for favorite teams, local news or regional weather may be seamlessly integrated through in-car infotainment systems. Gaming, event ticket purchases, and social media integrations follow logically from here. These are just a few of the novel and natural use cases likely to evolve around in-car video.

Our phones have provided mobile entertainment for years but the true mobility (cars, trucks, ridesharing, robocars, heavy equipment, etc.) revolution is just beginning. In-cabin networked screens delivering the right information, or entertainment, to the right person at the right time is going to fundamentally change our relationship with our cars. What’s more, autonomous vehicles are headed our way sooner than many may think. Germany’s Autonomous Driving Act, which passed in 2021, laid the groundwork for recent laws allowing Level 4 (High Automation) cars to hit the road this year. Waymo made its driverless taxi service available to consumers in San Francisco (my hometown) in the summer of 2023 and will soon expand to the rest of the Bay Area. So, stay tuned! We’ll take a closer look at what’s coming with autonomous vehicle technology in the next post.

Stay up to date on the latest technology and insights from DTS here.