Network Service Providers Have Opportunity to Help Consumers Address “Tyranny of Choice” by Offering Personalized Content Discovery

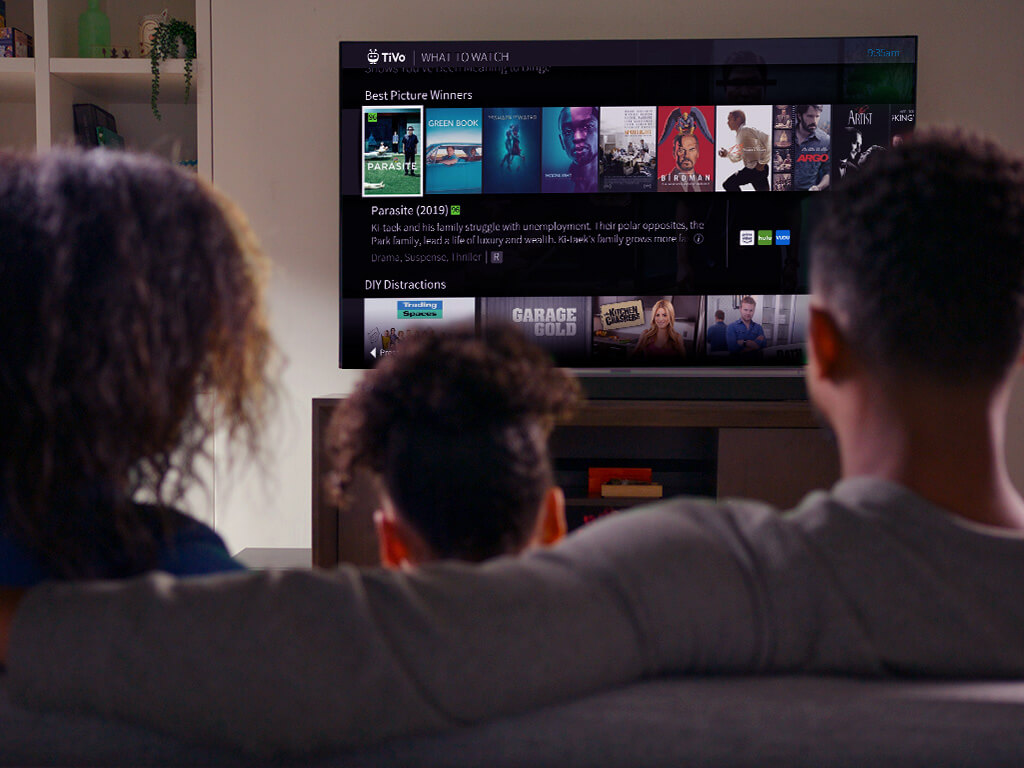

Many observers have noted that we live in a “Golden Age” of content that has provided viewers with unprecedented access to high-quality entertainment tailored to a wide variety of tastes. However, finding the right content at the right time is often a frustrating experience for consumers. The complexity associated with navigating a plethora of proprietary libraries from different content providers can lead to a state of paralysis-by-analysis that degrades the quality of experience (QoE).

Network service providers (NSPs) that focus on addressing this “tyranny of choice”—by aggregating and curating experiences to streamline the content discovery process—will find themselves in an ideal position to build market share and reduce churn.

These were among the conclusions of a breakout session on Pay-TV trends during a recently-held Xperi Media Day event moderated by Chris Ambrozic, Vice President of Discovery at Xperi and featuring expert commentary from Jonathan Bullock, Chief Product & Strategy Officer, Hotwire Communications, as well as Kevin Lenhart, General Manager of Pay-TV at Xperi.

Good News: Viewership Remains High; Bad News: So is Complexity

After experiencing a significant bump in viewership through the most difficult phases of the COVID-19 pandemic in 2020 and early 2021, many analysts and pundits projected a reversal of content consumption patterns as the nation—and the world—emerged from the crisis.

According to Xperi’s Lenhart, that shift has not proven to be the case. While there are many questions about what a return to a “new normal” will look like in the wake of the pandemic, the results of recent research conducted by TiVo/Xperi indicate that it will not include a reduction in video engagement.

“Our most recent research suggests that viewership remains high, with consumers in the United States spending—on average—4.5 hours a day enjoying video content. What is changing is how people consume their content. They are increasingly spreading their time across Pay-TV (38%), subscription video on demand (31%), advertising video on demand (10%) and even virtual multichannel video programming distributors (8%) that aggregate live and on-demand TV,” said Lenhart.

Hotwire’s Bullock agreed.

“There is no doubt that we experienced a massive COVID spike. But since then, demand for video content has not come down far. In fact, viewership has remained pretty steady,” noted Bullock.

There are some interesting subtrends, however, that offer insights into behavioral shifts that are redefining what it means to succeed in the content distribution and management sector. For instance, while news (especially local news) and live sports have driven general demand for linear content, different demographics are looking for very specific experiences in the on-demand world.

“This creates fragmentation which leads to confusion and frustration. Addressing this challenge for consumers is where Hotwire has placed a lot of its efforts and focus. Our goal is to provide a seamless experience in which consumers do not have to jump from one platform to another, which wastes time and degrades the quality of experience,” said Bullock.

The numbers, observed Lenhart, bear this observation out.

“The variety of options has indeed grown. In 2018 consumers utilized the services of a little over six content providers. In the fourth quarter of 2021, that number rose to nine streaming providers,” he said.

TiVo/Xperi research suggests that the low double digits may represent the limit to the number of streaming video services households are likely to use. But even within this limit, the variety of options is enough to create frustration and confusion.

“A significant segment (60%) of consumers report that it is hard to find good TV and movies to watch. And over half (55%) admit that they are spending too much time looking for video entertainment,” cited Lenhart.

It is a trend that is causing “cord-cutters” to revisit what they want from their ability to access a diverse array of content experiences.

This, suggested Lenhart, is playing to the strengths of NSPs like Hotwire, which have focused on developing personalized content discovery (PCD) strategies that aggregate—and ultimately curate—content for consumers who want to cut to the chase and enjoy their entertainment experiences.

According to Bullock: “Consumers increasingly realize that the number of decisions they have to make to optimize their home entertainment experiences has risen considerably. Do they have the right broadband access speeds? Can they integrate content across their home Wi-Fi networks? Are the growing number of devices in the home able to capture and deliver experiences to consumers in a satisfying manner? The questions and issues go on and on,” he said.

It is a situation that has triggered demand for content aggregation and overall complexity management of connected home resources. Services like PCD, consolidated billing, and enhanced management of in-home network and device performance help manage this complexity.

What is notable, he added, is that interest in having NSPs perform this complexity management function is not just coming from consumers.

There is also growing demand on the sell-side of the equation—including streaming providers—in having a trusted NSP partner manage content aggregation, curation, and billing, while also taking on technical support for network performance.

This is particularly true as the industry fully embraces the nuances of personalization, observed Xperi moderator Ambozic.

“The demographics and psychographics of demand manifest themselves differently for individuals depending on the time of day and other intangible variables—like mood. Sometimes viewers seek the content they want to consume with a high level of precision and intent. Other times, the same individual will be open to suggestions—but they want a service that will present relevant options to choose from,” he said.

PCD capabilities, stated Lenhart, offer a proven path to tailoring experiences for each individual user. In fact, viewers who utilize PCD to find content churn three times less than those who find content using traditional means. It is one of the technologies, added Bullock, that Hotwire Communications has been able to earn a Net Promoter Score of 68—an exceptionally high performance, considering that the average score in the internet service provider industry is 16 and 33 is considered high.

“That is why,” concluded Lenhart, “Hotwire and Xperi continue to work closely together to harness personalized content discovery technology to provide consumers with the cleanest possible path to optimizing their content consumption experiences.”