From its inception and for a long time thereafter, TV watching was entirely linear. Back when Bob Dylan wrote his famous protest anthem “The Times They Are a-Changin’” in 1963, the various TV channels had a set schedule and viewers would use a (usually printed) guide to decide what they wanted to watch, based upon what was available at the time they wanted to watch.

Now we are in the era of streaming. Viewers have a seemingly endless array of choices from dozens of different streaming providers, whether they choose to watch on their smart TV, computer, tablet, phone or most recently in their car. The proliferation in the number of providers has accelerated a snowballing of available content, which has led to a paradoxical situation. The consumer is firmly in the driver’s seat of content discovery, while the traditional linear broadcast model has become less important. Content awareness is more prevalent and consumers have the ability to search with little concern for which service is delivering their content, or where and when they watch it. Freedom of choice has never been more at the forefront.

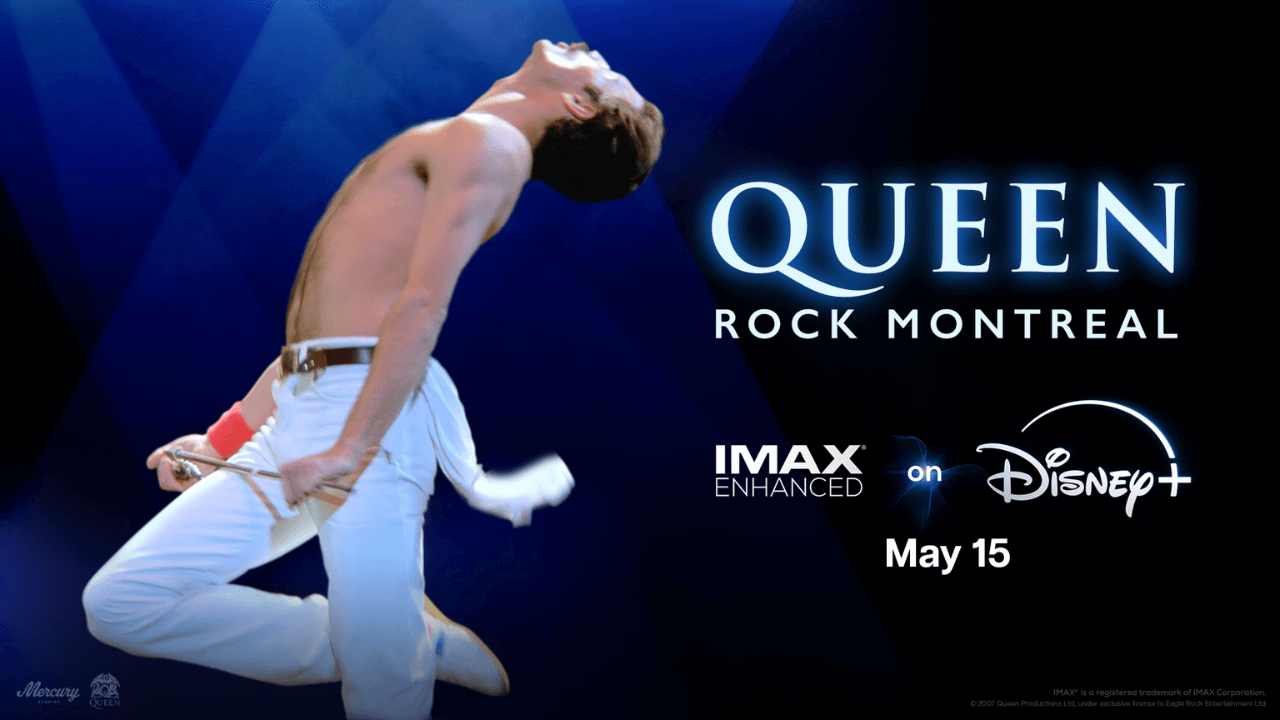

On the other hand, this avalanche of content has made finding something to watch a difficult challenge for many. There are several different types of delivery — AVOD/FAST, TVOD, OTT, linear, etc. — and dozens of providers to choose from. From mainstream options like Netflix and Disney+ to niche providers for every sport and affinity imaginable, each of these providers has a seemingly endless content library. Finding something quickly and easily can feel like a paralysing proposition.

The good news is that IPTV still offers a solution to all of this and puts the control of the viewing experience back in the hands of the consumer. This together with scaled and end-to-end efficient offerings enables the service providers to provide that consumer control while monetizing their platforms and content assets.

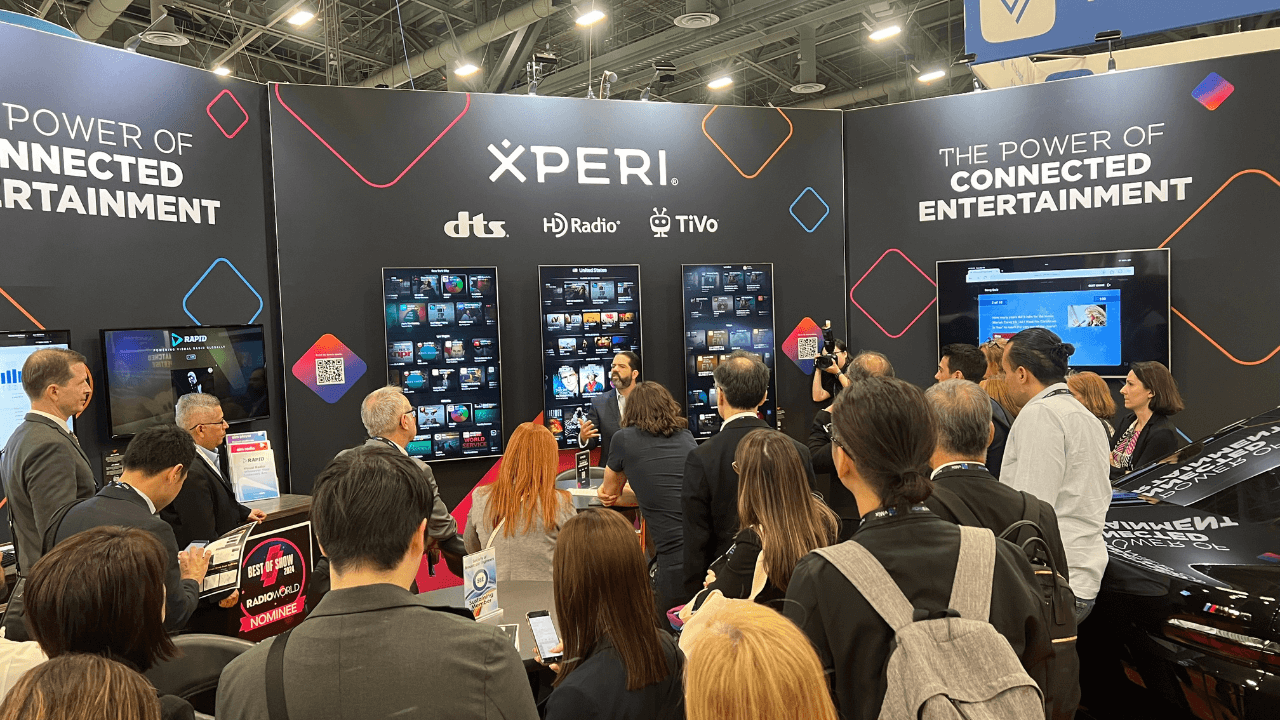

With all content delivered over IP, the integration of linear, FAST and OTT can appear seamless to the viewer and content-centric user experiences can get us to the content we love, faster. In its recent UK Video Trends Report, TiVo found that roughly two-thirds of viewers found it frustrating to use multiple apps to find what they were looking for. IPTV offers a scalable solution to this and by including personalised content discovery, can meaningly affect key industry metrics such as churn and engagement. Simply put, viewers spend less time searching for content, and more time actually watching it. With higher engagement and viewing time comes higher monetization returns for service providers.

Of course, the European market is no stranger to IPTV with the first launches rolling out between 2000 and 2002. Today, out of the approximately 190 million households that are considered to be IPTV-capable, approximately 66 million already subscribe to an IPTV service.

With all of the disruption happening across the content and end-user universe, IPTV is expected to see rapid growth over the coming years as fibre delivery becomes more prevalent, allowing high-bandwidth content such as 4K live sports to be broadcast over IP. In a recent report, Omdia Research forecasts that IPTV will have more than 39 percent of the region’s revenue share by 2030.

With this seasoned tenure in delivering IP video, the challenge for service providers is that many are on their second, third or even fourth IPTV platform iterations. There are complex (and distinct) ecosystem, operational and expense challenges that increase the difficulty of adhering to ever-changing market (and customer) demands, while maintaining operational and cost efficiency.

The inevitable next step is to explore ways to simplify their development, delivery and operational models to embrace the internal challenge of investing smarter, while still having video remain relevant to the bundle — a critical component to ensuring higher-margin products such as broadband and mobile have the lifetime expectancy and value that they need to drive top and bottom-line targets.

Herein lies another paradox: for service providers, the viability of video is still relevant to their business, but the bundle has been redefined by what’s at the fingertips of end-users in an evolving market, and the appetite for perennial internal investment softens.

The answer will likely lie in more of a “turn-key” approach that adheres to a fast-changing market with an industry-leading experience that also gives the service provider control of the user journey with agility to configure to more non-traditional segments — such as broadband-only and mobile. Ideally, this will all be combined with an end-to-end video ecosystem (UX through the video plane) that is scalable alongside their existing solutions, but with a refreshed expense model that ensures longevity of their platforms and customer base, and ease of transition in a cap and grow strategy.

The turn-key nature of such a solution also accommodates the growing ISP segment and fiber build-outs, where simplifying that ecosystem and delivery model allows for video to be an OpEx-friendly part of a high-investment fiber buildout strategy while also helping to protect the investment. Strategically, this allows executives to focus more on new reoccurring revenue streams from monetization and less on ecosystem complexities, consumer engagement or churn rates.

Stay up to date on the latest technology and insights from TiVo here.