There has been an avalanche of buzzy coverage over the past couple of years on EVs and self-driving vehicles, rife with skepticism that neither trend will ever achieve full traction. More recently, the news has been something of a split screen. When it comes to EVs, there has been a cascade of automakers announcing a pushback of their electrification plans, even as EV sales soared to their highest point ever in Q2, although the growth rate has slowed considerably year-over-year.

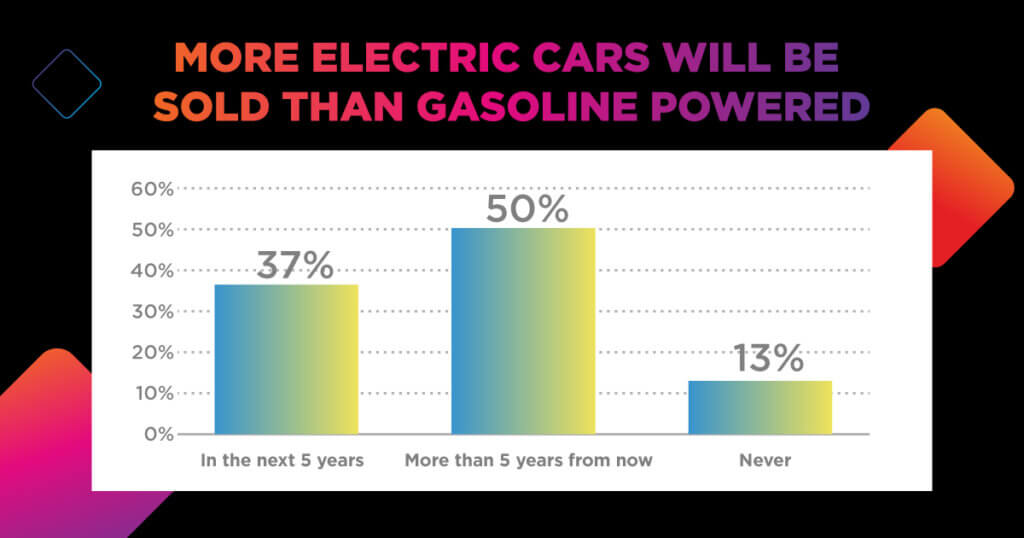

But, the reality is that most of the consumers who were going to purchase a premium EV (e.g., Tesla) have already done so, while more affordable models coming onto the market mean EV prices should eventually be within reach of non-premium purchasers, fueling adoption. According to the International Council on Clean Transportation, prices for EVs with a 400-mile range could equalize with gas vehicles sometime between 2029 and 2033 — and those with shorter ranges, even sooner. And even some of the most ardent EV skeptics seem to be changing their tune. While it remains to be seen if Donald Trump, who has historically been anti-EV, can be swayed by his recent alliance with EV pioneer Elon Musk, WSJ columnist Christopher Mims proclaimed his changed viewpoint in his August column: “What Americans Get Wrong About Electric Cars.” And, just this month, in the New York Times article, “The Electric Vehicle Future Is Coming. Just a Little More Slowly,” auto industry reporter Jack Ewing confirmed that while OEMs are pulling back, they are not abandoning EVs or the infrastructure to build them, saying “There’s still a consensus among carmakers that everything will go electric…It’s just a question of how long it’s going to take.” The inevitability of EVs as part of the vehicle landscape, while at a more leisurely pace than originally predicted by industry pundits, continues to be reflected in Xperi’s annual Connected Car Trends Report in which 87% of consumers predicted that, within five or more years, EV sales will outpace ICEs (internal combustion engine vehicles).

The news has been even louder on self-driving vehicles, with a recent Forbes survey showing that 93% of Americans have concerns about some aspect of self-driving cars, with safety and technology malfunctions topping the list. On the other hand, in San Francisco, Phoenix and LA, the technology is ploughing ahead with residents routinely seeing driverless futuristic-looking Waymo taxis (sensor and camera-equipped electric Jaguar I-Pace SUVs) roaming around their neighborhoods. While the Alphabet-owned company (Google’s parent) is well ahead of General Motors’ Cruise and Amazon’s Zoox, those behemoths are, nevertheless, attempting to nip at its heels.

But is all this visibility easing consumer fears? Earlier this month, a couple of LA NPR journalists tracked their somewhat nerve-wracking Waymo ride experience, reporting that the Waymo was almost too cautious, except when it ran through a red light — not the best recipe for building confidence. Nevertheless, they reported that overall it felt safe and they eventually “calmed down…at least enough to enjoy a Sabrina Carpenter song on the pop preset station…”

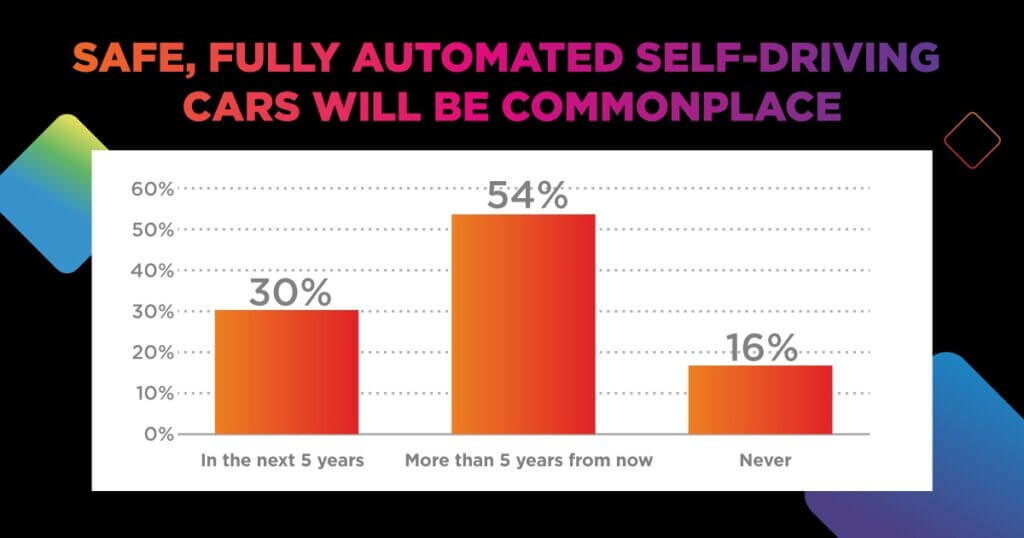

And, according to the NHTSA, Waymo has driven a total of 7.14 million miles and beat human benchmarks with a 57% reduction in police-reported crashes and an 85% reduction in crashes involving injuries…but building confidence with consumers needs flawless performance. Xperi’s recent trend report confirms consumers’ paradoxical skepticism/acceptance of autonomous vehicles: 69% say they currently do not trust self-driving technology, but most, 84%, believe self-driving vehicles will eventually be commonplace, with 30% predicting it within the next five years.

So, why is this of particular interest to us here at Xperi? Well, think about those two NPR reporters finally relaxing as they chilled to Sabrina Carpenter…or current EV consumers, with time to pass while charging their vehicles. Both transportation modes come equipped with large screens, begging for terrific entertainment content either for EV owners to consume while stopped to charge or, for consumers in a self-driving taxi, no longer burdened with a chatty driver, to enjoy — or for those with their own self-driving car, a chance to catch up on content.

Clearly, consumers need more reassurance on EV pricing and charging accessibility, and iron-clad safety assurances for driverless vehicles. But, based on our consumer data, it is very likely that these vehicle modes are a key part of the automotive future (albeit a delayed one), especially as consumers increasingly value the vehicle as a third space, as much as, or more than, other traditional third spaces. And to fill this third space, whether the vehicle is an EV, a self-driving vehicle or a good old-fashioned combustion engine vehicle, our data shows that consumers are raising their hands to demand much more from in-vehicle entertainment — and the screens to play it on, no matter the vehicle’s drive train or driver. Over half of all car owners say they are interested in front and rear cabin screens.

Inherent in these trends is a need for robust, immersive in-vehicle entertainment to fill up those screens. And this is precisely what platforms like our DTS AutoStage are designed to do: evolve ahead of the market for all vehicle modes with advanced, immersive and personalized content, from video to audio to gaming, that adjusts on the fly according to consumer preferences. In fact, we are already doing it in close to 10 million vehicles from Mercedes to Hyundai. And, given the changing timeline of consumer adoption of EVs and self-driving vehicles, a crucial feature of the DTS AutoStage platform is its ability to be added to vehicles through over-the-air (OTA) software updates, which can continuously and in real-time, adjust as technology modes and car owner needs evolve. In addition to ease of platform updates, AutoStage’s ability to easily integrate content can handle changes in consumer tastes. For example, our data shows that today’s consumers are more likely to watch short-form video than TV or movies if they have 20 minutes of downtime in the car, so generating access to a wide range of short-form content is key. But if that changes as adoption increases, a content-first platform can automatically adjust in concert with consumer trends

All new technology takes a minute to habituate and will undergo multiple ups, downs and technology modifications before mass adoption. EVs and autonomous vehicles are no different. Nevertheless, indications are clear that, in spite of some negative press, they are on their way. At Xperi, we firmly believe it is as important that automakers think ahead to how future EV/self-driving consumers want to consume content, as it is to consider those who are currently purchasing ICE vehicles. And, whatever the vehicle mode, today’s most forward-thinking in-cabin entertainment technologies must have the flexibility to provide car owners, drivers and passengers what they want: bigger, better and more personalized content-first in-vehicle entertainment.

For more information about DTS AutoStage, click here.